Targeted Average Annualized Return

As a fund heavily focused in the sunbelt states and primarily Central, Texas, this fund provides exposure to the high growth corridor in the United States. Using a thorough underwriting process involving a 3rd party engineering firm, the fund is selective on the projects it funds and works meticulously to ensure the underwriting aligns to a number of key metrics. As we often say, its not so much about paper profits as it is about understanding the potential downside risks.

Join an impressive community of investors, institutions, and backers.

Introducing the flagship Centauri Income Fund

A fund that provides capital solutions to ground up development projects in a range of real estate asset classes to diversify risk based in the southwest of the U.S.

Introducing the Centauri Flex Development Fund

A fund that is focused on investing into the development phase of Flex Industrial Parks in Texas.

Learn how you can invest with Centauri

Centauri Capital Funds

Invest in a diversified portfolio of real estate development projects with strong growth potential in the Southwest.

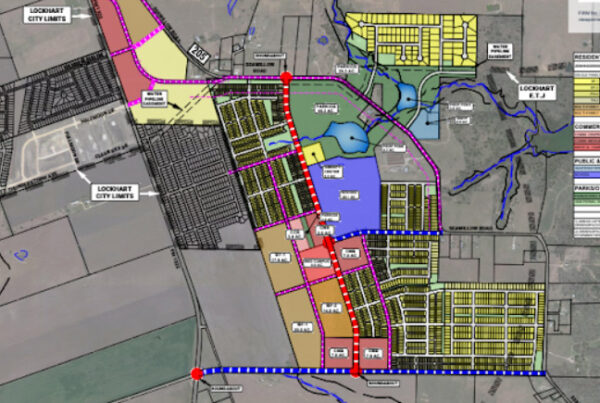

Centauri Flex Development Fund

A fund that is focused on investing into the development phase of Flex Industrial Parks in Texas.

Why Real Estate Development?

Why Centauri Capital?

We have created an investment model that maximizes return potential, and minimizes risk exposure that is derived from our development experience and keen awareness of market movements to provide stable income and liquidity.

Why Now?

There has been a chronic shortage of housing across the country for years. Various studies put this shortage at between 4 million to 6 million homes. There is no better time to invest in projects that deliver products to meet the ravenous demand for housing induced by population growth and this chronic housing shortage.

Why You?

You want investments that are not subject to mass hysteria, you want attractive returns, you want stable income, you want opportunities for upside in returns, you want to invest in projects that have positive impacts on people’s lives. That’s You.

FAQs

Who can invest in Centauri Capital Funds?

In order to invest in Centauri Capital Funds, investors must meet the criteria of being an accredited investor.

What is an accredited investor?

“Accredited investor” has been defined by the Securities and Exchange Commission (SEC) as a test to determine who is eligible to participate in certain private capital market offerings. Generally an individual person is an accredited investor if they: (1) had an income of $200,000 over the last two years (or $300,000 jointly with a spouse or spousal equivalent) and reasonably expect to satisfy the same criteria in the current year, (2) have a net worth of over $1,000,000, either alone or together with a spouse or spousal equivalent (excluding the person’s primary residence) or (3) hold a Series 7, Series 82, or Series 65 financial services license and is in good standing. An individual must be an accredited investor to invest with Centauri Capital.

Can international investors participate?

Generally, as a non-U.S. investor you must be a qualified purchaser to invest with Centauri Capital. Generally, an investor is a qualified purchaser if the investor (1) holds investments greater than $5,000,000 or (2) is acting on behalf of other qualified purchasers who, in aggregate, own and invest greater than $25,000,000 in investments.

Our website and offerings are directed solely to persons located within the United States. If you live outside the United States, it is your responsibility to fully observe the laws of any relevant territory or jurisdiction outside the United States in connection with any purchase of membership interests, including obtaining required governmental or other consents or observing any other required legal or other formalities. Unless otherwise expressly indicated by us, we have not registered or qualified the offering of shares in any jurisdiction outside the United States.

I am investing through a business entity (i.e. a trust, LLC, partnership or corporation). How does an entity qualify as an “accredited investor?”

In addition to qualifying as an individual, there are other categories of accredited investors which will satisfy the SEC’s definitions: (1) any trust, with total assets in excess of $5 million, not formed specifically to purchase the subject securities, whose purchase is directed by a sophisticated person, or (2) certain entity with total investments in excess of $5 million, not formed to specifically purchase the subject securities, or (3) any entity in which all of the equity owners are accredited investors.